Questions and Answers

The following is a list of questions and answers to get you thinking more deeply about the main financial policy issues we should all be concerned with.

Why is there "Poverty in the Land of Plenty?

How will the Wealth Pumps fill THE GAP?

What is the difference between "demand" and "effective demand?"

Why is there not enough purchasing power or effective demand?

If government has the right to issue money on "the full faith and credit of the people of the United States" like the Constitution says, then why is the money being issued by the Federal Reserve and by other central banks at interest to the people who must pay rent on their own property throughout the world?

Isn't the Federal Reserve a government organization?

What is wrong with our present economic system?

What is the difference between real credit and financial credit?

How will society prevent a parasitic class from emerging again?

What do we do with the National Debt?

What about US Savings Bonds?

How is depreciation of capital equipment to be dealt with?

What incentive is left for Producers to produce?

How is this scheme any different than Socialism?

What incentive is there for inventors who lack significant personal capital?

What incentive is left for Consumers to work, with such a generous National Dividend?

What do we do about people who willfully sabotage their jobs to avoid their duty?

What form(s) of investment will be available to Consumers so that they may increase their personal wealth?

How do we arrive at a Compensated Price of 25-75% for Consumer Pricing?

What is the economic impact of producing goods nobody wants to buy?

Where does the money come from to pay the National Dividend so as to be neither inflationary nor deflationary?

How are we to deal with imports and exports?

How do we determine who are the most worthy of having their ideas capitalized?

How do you morally justify giving the National Dividend to so many unemployed people?

What will our workforce look like in this new economy?

Q: Why is there "Poverty in the Land of Plenty?

A: The root problem of our economies throughout the world is that there is not enough purchasing power in the economy to match the maximized production capacity with the unbridled demand of Consumers. There is no insufficient effective demand (or purchasing power) to enable Consumers to buy all the products that they desire from the Producers. We call this deficiency of purchasing power the price gap.

Q: How will the Wealth Pumps fill THE GAP?

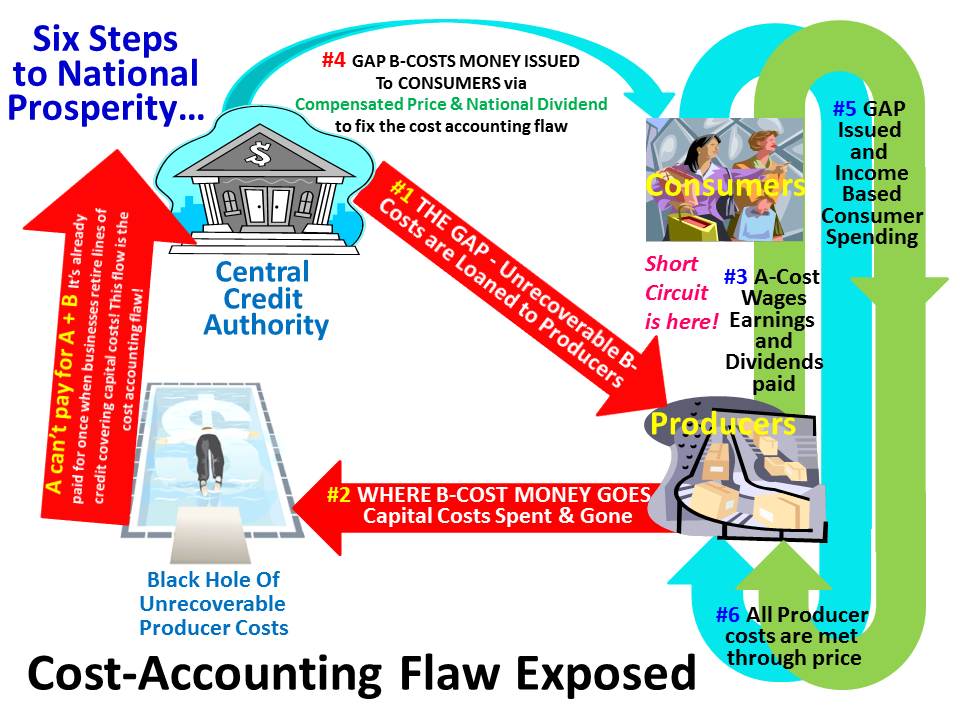

A: The money Producers spend to bring products to market is money that is impossible to recover from the price of merchandise. The way the economy presently works has a built-in accounting flaw that very few people throughout the entire industrial revolution have noticed. Notice (in the following diagram) that there is no blue flow from producer to consumer. That portion of producer costs went to red flow #2 and is now unavailable to consumers. It is literally tied up in capital costs. Only by lending this money to Producers (flow #1) and giving the same amount to Consumers (flow #4) so the money can eventually be spent (flow #5) return to producers so they can pay their loans off (flow #7) can the shortage of money needed to fill the price gap for consumers be filled in a way that the producers can recover their costs. Please note that the money paid in wages (flow #3 in GREEN) is eventually returned to producers as they spend it, and the producer can re-use this money to pay more wages.

Q: What is the difference between "demand" and "effective demand?"

A: Demand is "to ask for peremptorily or urgently" but effective demand is demand backed by the substance of ability to pay. We have no shortage of demand in our economy, but there is a terrible shortage of effective demand.

Q: Why is there not enough purchasing power or effective demand?

A: Under our current system of financial credit, all money comes into existence by the issuance of debt. This debt-based money is in short supply because it is exclusively and closely controlled by financiers who do what all monopolies do - extract the maximum profit while delivering the minimum product at the cheapest cost of production. They are thus motivated to maximize interest earnings by keeping their "product" of money in short supply. Banks are also primarily interested in the return of their money - and are less interested in the merits of a business venture for which the money is needed. Furthermore, if a new and innovative venture is proposed that threatens an existing capital "investment," the "powers that be" will oppose it despite its merits to society. How has this hurt society to date? Here are some facts that prove these assertions.

- Tesla's proven "radiant energy" car from the 1930's was never built, and we have burned fossil fuels ever since.

- Tesla's wireless free radiant energy transmission technologies from the 1920's were squashed by JP Morgan because they threatened his bank's investment in the electrical utility companies.

- Amygdaline and oxygen therapies as viable cures for cancer have been suppressed for over 50 years because of their threat to the pharmaceutical industry as "unpatentable" solutions.

- Carburetor technologies that allowed 3-4 ton luxury "land yachts" of the 1970's to get 100 MPG were buried because of their threat to "big oil" profits.

Q: If government has the right to issue money on "the full faith and credit of the people of the United States" like the Constitution says, then why is the money being issued by the Federal Reserve and by other central banks at interest to the people who must pay rent on their own property throughout the world?

A: Good question. The only reasonable answer is that inept politicians and an ignorant public failed to learn the lessons of history or heed the warnings of great leaders like Thomas Jefferson and Andrew Jackson or the arrogant boasts of men like Nathan Rothschild who said, "The few who could understand the system (checks, money, credits) will either be so interested in its profits, or so dependent on its favors, that there will be no opposition from that class, while on the other hand, the great body of people, mentally incapable of comprehending the tremendous advantage that capital derives from the system, will bear its burdens without complaint, and perhaps without even suspecting that the system is inimical to their interests." Once "they" got control of the issue of our money, our state-controlled education system was then rigged to ensure that future generations would not be alerted to the dangers of this faulty system. Our foolish fore-fathers gave our public property over to private financiers, and we have had endless cycles of boom and bust ever since. We are no different than the serfs of medieval England who had to continuously manure the fields and tend the flocks and herds of their lords in order to retain an inheritable right to live on the land. Today our "manure" is interest to financial lords. Nobody owns their property in allodium (land owned absolutely; land owned and not subject to any rent, service, or other tenurial right of an overlord); and if you think you own your home after paying off your mortgage, then stop paying your property taxes, and you will soon find out who really owns "your" home.

Q: Isn't the Federal Reserve a government organization?

A: It is neither Federal, nor are there any reserves. The Federal Reserve is entirely owned by member banks, and they make their money up out of thin air. That money is backed only by the "full faith and credit" of the nation's people. This is the public property of "We the People" - not the private property of the "powers that be!" Ultimately, the Fed's policies are completely driven by the interests of their owners. The Chairman of the Fed is appointed by the President but there is no accountability, and there has only been one public audit in its entire history, performed in 2011... The highlights of that audit were reported on Senator Bernie Sander's web site. He stated:

"As a result of this audit, we now know that the Federal Reserve provided more than $16 trillion in total financial assistance to some of the largest financial institutions and corporations in the United States and throughout the world. This is a clear case of socialism for the rich and rugged, you're-on-your-own individualism for everyone else."

The full United States Government Accountability Office report is available HERE

Q: What is wrong with our present economic system?

A: The root cause of all our economic woes is that there is not enough effective demand with which Consumers can buy the desired products made by Producers because of 1) the gap, and 2) unearned and fraudulent usury. The only "effective demand" presently in our economy is credit issued by banks as debt. Unfortunately, they issue and withhold this debt at inappropriate times within national production cycles to the nation's detriment. Their sole motive being greed for gain. To make matters worse, the economic policies for its issue are entirely in the hands of the "powers that be" -- a small group of elites of whom not one in a million people are a member.

We need to put the issuance of money under the administrative oversight of elected officials and install capable professional accountants to oversee its proper implementation for the public benefit. We need to deliberately change our economic policy with respect to money and commerce. The focus of our economy must become the efficient production of goods and services with efficient distribution of same to Consumers. We need to stop treating money as a commodity and start using it as a utility or "ticketing system" as Major Douglas expressed it. The purpose of production is consumption - not profit for the few.

Q: What is the difference between real credit and financial credit?

A: Real credit is the correct estimate of an entity's ability to produce and deliver goods as and when and where required by the potential Consumer. Financial credit is money issued by the "powers that be" based on their private agenda and their belief that the money will be returned on time and with interest. Financial credit only has an indirect relationship to goods produced via the medium of money. The purpose of production is to be consumed. Money is treated by the "powers that be" as a commodity that they own when it should really be a utility that We the People own to facilitate joining Consumers to the goods of Producers to satisfy the needs and desires of Consumers and thus reward Producers for doing so. From an economy's perspective, the Gross National Product is the clearest available evidence of the real credit of a nation and its ability to justify issuance of same. Given that this underlying wealth is the property of the Consumers and Producers jointly (since one cannot exist without the other), what legitimate claim do the "powers that be" have on this wealth?

Q: How will society prevent a parasitic class from emerging again?

A: The main mechanism of wealth accumulation for the families of elites as well as organizations such as churches has been tax-free accumulation of wealth and the charging of "rent" on that wealth. This class of people was known in England as "rentiers" a century ago. It is one thing for a man to earn a great fortune by his hard work and genius. It is another for that wealth to still be in the hands of progeny centuries later. It is also true that the businesses these people put in place are prosperous because of the employees to a great extent.

An ideal solution would be for the equity (i.e., shares) of a business to pass to employees upon death of employees and business owners. This would leave the wealth of the business intact to be equitably redistributed across the living employees. It would serve as an effective pension plan for retired employees and incentive for new talented employees to join. Obviously, the proportion of dividends will be tied to the wages earned as well as the shares held by key founders and contributors. A President or significant contributor will have a significantly larger dividend than, say, a janitor. Merit is valuable and deserves its reward. One important provision is that most people are married and if a spouse is lost, the survivor's financial needs will not change. For this reason, the dividend incomes should be received by the survivor until their death. At that point, the dividend will cease and be reapportioned among the rest of the living employees.

What happens to the great estates of our most successful entrepreneurs? The chattels can be left to beneficiaries, and the business equity will revert back to the companies. Their children will have the same relative advantages and disadvantages as the rest of us. As Warren Buffett said of his estate, he intends to leave his children with enough so they can do anything they want but not enough that they can do nothing. That is a noble intention worthy of emulating.

Q: What do we do with the National Debt?

A: Our national debt is really our national credit, and it has been built up exponentially over the past 100 years by demanding $3 for the repayment of every dollar issued - the net effect of a 30 year bond at 5%. It is also caused by the cumulative B costs that have built up over time. It was fundamentally incurred via deficit spending to fill the price gap that would otherwise bankrupt our Producers. Since there is never enough money in the economy to pay even the principal - never mind the interest - the debt is piled upon debt.

Consider this simple model: If you issue a 25 year bond for $1B at 5% interest, you will pay $3B to settle the debt by the end of the term. The $2B in accumulated interest does not exist, so the only remedy is to issue more bonds to cover it; and the first $1B has long since been spent. In 25 years, the first $1B becomes $3B; in 50 years it becomes $9B; in 75 years it becomes $27B and in 100 years it becomes $81B. In practice the debt isn't growing that fast because bank spending benefits us and blunts the effect of this explosive growth. Economists call this parabolic growth in debt a "bubble." I call it a fraud. Since this debt held by banks was incurred fraudulently, we simply need to repudiate all debt owed that is and was incurred through the open market operations of the Federal Reserve and their member banks. Any attempt to deny that it was fraud with intent is easily defeated by citing the efforts of Soddy, Douglas and their many advocates throughout the world that these same "powers that be" worked so hard to silence. This repudiation is both fair and reasonable because financial credit comes into existence when it is loaned, and it disappears when the debt is retired.

We simply cancel "their" Federal Reserve Notes financial-credit money and replace them with our legitimate real-credit money. We substitute all currently issued debt credit with our new usury-free public credit so that all Consumers and Producers preserve their purchasing power. Wealth Pumps will do the rest. All outstanding converted loans will be interest free. Producers can examine the portion of their unsold inventory of products (i.e., wealth) that represent B costs, and the A portion of the debts will be forgiven to come in line with Wealth Pump mechanics. That same portion will be distributed to Consumers as dividend to facilitate the purchase of this existing wealth.

Q: What about US Savings Bonds?

A: Because these bonds were purchased by citizens, they will be paid back to the lenders immediately with all owed interest by the National Credit Office so that they get full value. Since loans are available interest free by businesses and because government now gets directly funded by the National Credit Office, they are no longer needed by government to fund its operations and need to be settled in the best interests of all parties.

Q: How is depreciation of capital equipment to be dealt with?

A: Depreciation will be included in the B costs of production to cover equipment wearing out and/or becoming obsolete. Obviously, this will be factored into the price.

Q: What incentive is left for Producers to produce?

A: Producers take profit on their risk capital at the level the market will bear in a competitive economy - just like at present. This becomes the only means available in society to make money work for you, and to become wealthy, so this is a sufficient incentive. Producers come into being because they recognize an unmet need, see an opportunity to improve on a product or more efficiently deliver it at lower cost. The lion's share of start-up cost will typically be obtained as an interest-free loan from the National Credit Office if the business plan is deemed worthy. The investor's own capital investment and/or that of private investors will be seen as further evidence that their business plan is worthy, and it will provide additional financial reward for same.

Q: How is this scheme any different than Socialism?

A: In socialism, all means of production are owned by the state, the state directs all production and all money is obtained from and controlled by private financiers. There have been no exceptions in our modern era. With our Economic Democracy, the Consumer decides what will be produced through the "financial democracy" of his right to vote his purchase. The currency is a public "not for profit" utility. All the businesses are financed by the National Credit Office and owned by Producers and to a greater or lesser extent, by their employees. There is no state-planned economy. It is a Consumer-driven economy. As C.H. Douglas stated, "it is a democracy of Consumers who vote with their money in cooperation with an aristocracy of Producers."

Q: What incentive is there for inventors who lack significant personal capital?

A: Since "stock options" and other financial derivatives are to be made illegal (because they are potentially mischievous) an investor with an idea that has significant merit needs to do three things to obtain business startup capital:

- Copyright or patent their idea to protect them as the inventor and get paid royalties for its use from existing businesses that deploy the invention to market.

- Find an "angel" Producer and/or National Credit Office to invest in the new venture.

- Negotiate an equitable share of investor capital in return for vending the idea into the venture.

Alternatively, the inventor is always free to introduce the process, product or technique to the company they work for since they will benefit via their Producer bank share. They may also negotiate a larger salary, royalty or equity stake.

Q: What incentive is left for Consumers to work, with such a generous National Dividend?

A: The primary incentive to work is the National Dividend itself and the potential to have it withheld. Everyone who collects the National Dividend is required to work a fair share of his/her life. After meeting their minimum obligation, a person need only work if they wish to. This strategy is predicated on the fact that in the worst case scenario, only 10-30% of society is needed to do all the work necessary to support our economy. A person's National Dividend will only be withheld after a certain grace period and only until he/she yields to the requirement to do his/her fair share of work. This is actually in keeping with the long-held principle of society to work for our bread and keep.

Q: What do we do about people who willfully sabotage their jobs to avoid their duty?

A: The only way to "fire" someone is if a majority of co-workers vote the person terminated after an open tribunal with a jury of peers is held to discover all the facts and render judgment. A worker will be a candidate for dismissal upon the testimony of two or more fellow employees. If the tribunal rules that the person has been willfully negligent in meeting their duties, a recommendation will be made to have their names removed from the National Dividend for three months. If they are deemed simply lacking in skills or aptitude, they may be reassigned or retired from the work force.

Q: What form(s) of investment will be available to Consumers so that they may increase their personal wealth?

A: All forms of usury are repugnant. There is no need for bonds for public works or the raising of capital because money is available from the National Credit Office and/or private investors upon submission and approval of a viable business plan. There will be a modest stock market for the public to invest capital in new or existing ventures. In addition, workers obtain a share of the corporation for whom they work and the share survives until their death. People are free to sell their shares in the open market if they so desire but their share value expires upon the original employee's death. The only investments that return a profit grow in capital are equity share dividends and personal loans where the use of the money is given up or rented out if you will. If a person is unable to obtain financing for a venture, is willing to pledge personal property as collateral and he can find someone to lend money at interest, he is free to do so but the very economic framework of our society ensures that this should be unnecessary for worthy projects and will happen rarely.

Q: How do we arrive at a Compensated Price of 25-75% for Consumer Pricing?

A: There is the observation that our cost of national production is approximately four times larger than our spending as expressed by the total national consumption. In the initial phases, we need to transition people from make-work industries and inefficient production processes so a smaller discount will be available initially until efficiencies are improved. Once the economy is operating at capacity of Consumer spending and sufficient economic metrics have been gathered, we switch to using the "just price" mechanism that measures the ratio of consumption to production. For example, if we are producing goods 20% faster than they are being consumed, we set the compensated price to 20% plus the gap computed for the last fiscal quarter minus the money added via the National Dividend. If we consume faster than we are producing, there is no Compensated Price because clearly there is enough money in circulation to meet demand. The gap will eventually change this. Government may need to consider reducing the National Dividend under some circumstances. Such a condition may occur, for example, if there was a national outbreak of disease that wipes out a significant proportion of the population without destroying goods or capital equipment.

Q: What is the economic impact of producing goods nobody wants to buy?

A: This is a drag on the productivity of the nation. If a company produces goods that are unsellable (e.g., obsolete technology, poor quality, uncompetitive price), the price will be dropped as low as is necessary to liquidate them. If the company cannot produce a profit per the submitted business plan, the business will be forced into receivership because it will have insufficient sales and thus insufficient operating capital. The Producer capital will be lost under this circumstance. Therefore, the providers of that capital may wish to make a further investment as an alternative. The lack of sales will result in a business' inability to pay wages and inevitable resultant voluntary receivership. This will be the primary cause of early business failures. Upon going into receivership, a business' capital assets will be liquidated, and the capital will be returned to the Producer bank and/or government in the proportion that it was capitalized. Any surplus will be distributed to the investors and finally to the employees of the company. There is thus a real incentive for employees not to be a part of losing ventures by doing all they can to make their products of the highest possible quality at the lowest possible price.

Q: Where does the money come from to pay the National Dividend so as to be neither inflationary nor deflationary?

A: First the difference between the gross domestic product and the gross wages paid must be calculated in aggregate for the nation from corporate returns. This will yield the A and B portions of the GDP. Then the amount of capital created by Compensated Price must be calculated, based on the just price formula. Any amount remaining will be divided equally among every citizen and will be paid in monthly increments as the National Dividend. The National Dividend and Compensated Price flow through the economy much like a pump - a Wealth Pumps:

- Lending the costs of production to a Producer (domestic producers only) as an interest-free loan by either the National Credit Office as an interest-free loan or investor capital.

- Pumping that much money into the economy as a National Dividend and/or Compensated Price on the "collateral" of the production that is coming in the future as a result of that manufacturing in progress.

- When the goods come to market and Consumers buy this product, the Producer now pays the loan back, and the money is destroyed. If the funds came from investors, they are paid dividends and the capital is retained. Alternatively, the investor may want the capital returned along with interest. In the latter scenario, the Producer can get additional capital from the National Credit Office as needed.

- Now the Producer needs another loan from the National Credit Office to finance another round of production so the process starts all over again.

The following Figure illustrates Wealth Pumps:

Q: How are we to deal with imports and exports?

A: Imports add to the available pool of goods, so they are a credit to national production. Exports are a reduction of available goods, so they are counted as consumption and thus a debit. When it comes to exports, it is not in the national interest to sell for less than cost of production plus Producers profit unless the value of the imported (traded) goods are of greater real value than the offsetting loss. For example, there may be no platinum available as a natural resource, and it may be a vital component to our national interests. In this example we may be forced to incur a loss on an exported item to secure our needed national supply of platinum. The main point is that we must have balanced and fair trade.

Q: How do we determine who are the most worthy of having their ideas capitalized?

A: In a word, "merit." Within an existing Producers business, those people who have contributed the most innovation will be promoted to positions that allow them to direct the productive resources of the business enterprise and also command a better income. When new ventures are proposed, a rigorous business plan will be required. That business plan may be shopped with the National Credit Office and various investors and if found to have merit, will be suitably funded.

Q: How do you morally justify giving the National Dividend to so many unemployed people?

A: The first change that is needed is in our perception of the need for employment. It has been adequately demonstrated by hundreds of years of experience with our current economic system that with advances in technology, automation, and productivity there is no need for full employment to meet the human resource requirements of a fully utilized and efficient productive capacity. As a consequence, society is certainly worthy of a leisure dividend - a productivity increment that grows as efficiency improves. It has been estimated that a great deal of employment today is comprised of unproductive "make work" projects that will certainly be weeded out under our new economic policy. Major C.H. Douglas estimated in 1921 that only 30% of England's workforce was needed to meet the requirements of Producers. Productivity has made great strides since then, and the ratio is certainly even smaller today. If technological advances would render a job obsolete, in a world where everyone gets a share of the national economy via a National Dividend, how is that a problem - unless the only way they can get money is to work a job that doesn't exist?

So what will everyone do? They will do what they want to do once they have invested their fair share of 10-30 percent of their productive lives. Painters will paint, inventors will invent, musicians will make music, and outdoorsmen will enjoy the greater outdoors. Philosophers will ponder man's greatest good, parents will nurture their children, builders will build, and travelers will explore and travel. In a world where people are fully empowered to take advantage of all of society's production and benefits, why would they do otherwise? An unbelievable Renaissance will soon be unleashed!

Q: What will our workforce look like in this new economy?

A: Since only 10-30% of the workforce is needed to perform the total required work to satisfy Production labor, each person will only be required to put in a 10-30% lifetime effort as compared to today. Perhaps a person will chose to work 16 weeks out of the year or 16 hours a week or work every third year, or work for ten consecutive years followed by retirement - as seems best by negotiation between the citizen and the needs of Producers they partner with.

Download your own personal a copy of my book: Economic Cures "They" Don't Want You to Know About to get the whole story. Find it on the home page of this web site.